Are Coding Bootcamps Tax Deductible?

It’s that time of the year again! Are coding bootcamps and online coding classes deductible on your U.S. tax return?

Coding bootcamps like Hack Reactor, New York Code + Design Academy, and Epicodus are expensive and can cost from $850 upwards to $17,780 per program. Online courses like One Month or Udacity are cheaper, but can still be expensive, with costs ranging from $100 to $500 per month.

For the answer, we’ll look to IRS Publication 970: Tax Benefits for Education and the IRS summarization.

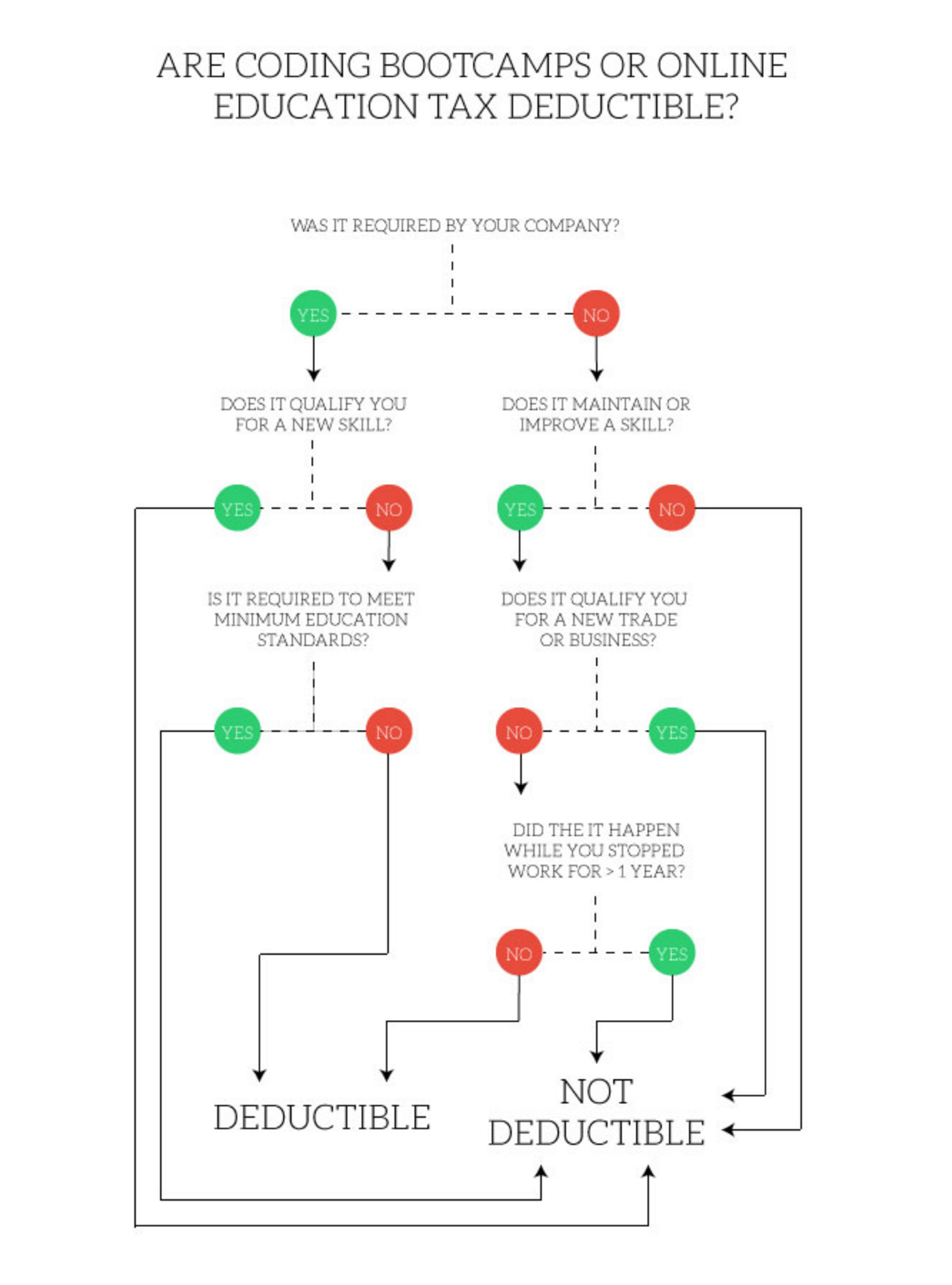

Was It Required by Your Employer?

Will your current salary, status, or job be affected if you don’t do the training?

If the answer is yes, then it is tax deductible.

However, there are two conditions:

- If the program qualifies you for a new skill, it is not tax deductible. To qualify, the program must only maintain or improve a current skill needed for your present work.

- Likewise, it is not deductible (even if it’s required) to meet minimum education requirements.

Example 1: You’re a developer at a startup using Rails. One day, your CTO drinks the concurrency Kool-Aid and demands all the developers to learn Node.js and become JavaScript pirates. “JavaScript everything, or walk the plank!” This would be tax deductible since it’s required to maintain your current salary/status/job.

Example 2: You’re a marketing guru but your company wants you to become a growth hacking ninja by having you learn code. This would not be tax deductible since it would qualify you for a new trade.

Does it Maintain or Improve a Skill?

Even if your employer didn’t require it, it may be tax deductible.

If it maintains or improves skills needed in your present work — this includes refresher courses, academic/vocational courses, or courses that look at current developments — it is tax deductible.

There are two conditions:

- If it qualifies you for a new trade or business, it is not tax deductible.

- If the education happens while you stop work for more than a year, it is not tax deductible.

Example 3: You’re a software development wizard who does contract work. You go through a program to learn Node.js — all your clients keep asking about Node.js!. The education would be tax deductible.

Example 4: You’re an investment banker who decided to trade in your Allen Edmonds for some flip-flops. You go to a coding bootcamp to learn software development. This would not be tax deductible (since you’re learning a new trade).

Example 5: As an ex-developer, you’ve spent the last two years dedicated to becoming a master chef. You’ve slowly realized that you have a terrible palate. You decide to go back to your old trade of code slinging and decide to take a coding bootcamp to work off the rust. This would not be tax deductible (since you stopped work for more than a year, even though the training did not qualify you for a new trade).

What If I Deduct It Anyways?

The beauty of tax is that it can be subjective.

This is especially true with startups where skills often intersect — especially with job titles like growth hacker, happiness engineer, and product guru.

My advice? Use your best judgment and consult a tax professional if you’re not sure.

Are you considering a bootcamp but worried about the tuition or living expenses? WeFinance for Bootcampers is the fastest way to crowdfund a personal loan.