Compound interest is the most powerful force in the universe.

-Albert Einstein (But actually probably not really)

My last job provided a cell phone plan for its employees, and when I left, I started paying around $70 a month for my phone (voice + text + data). Eventually I found a new plan that met most of my needs for only $35 a month. I was pretty excited: I knew that saving $35 a month meant about one more nice dinner a month, or a couple of extra days in a hotel on vacations over the course of a year.

If you’re thinking about a loan, though, it’s a lot harder to really conceptualize what a percent of interest or two is worth to you over the life of the loan. One reason for this is that you may not even know today how long you’re going to be paying that interest. Another is that over the life of the loan, you’ll have to pay interest on the interest you’ve previously accrued (the phenomenon known as Compound Interest). So how does shaving a couple of points of interest off a loan actually translate to dollars saved?

To help shed some light on this, I used WeFinance’s new loan interest calculator to show some sample outcomes for a common student loan profile. There are other loan calculators on the Internet, of course, but we built this to automatically compare both varying loan rates and varying repayment lengths, so borrowers can immediately see what the effect of all their options would be on one screen.

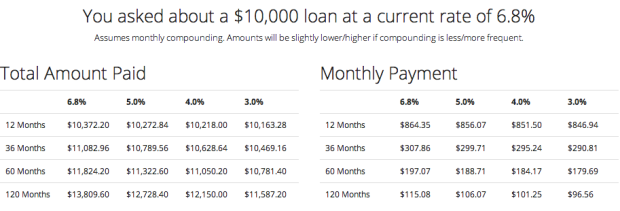

Consider $10,000 of debt in a Graduate/Professional Stafford Loan from one of the last several years, with an annual interest rate of 6.8%. (Link to this on the calculator)

As you’d expect, your interest rate isn’t as big a deal if you’re going to pay off the loan soon. A 6.8% loan on $10,000 for a year costs you about $150 more than a 4% loan. But paid off over 10 years, that gap widens to more than $1,600 difference, or about $15 a month for 10 years. And that’s just on ten grand of original debt-most grads have substantially more than that.

Shortening the duration of your loan goes a long way to saving money as well. For example, if you can find an extra $70 a month, by refinancing a 10-year loan at 6.8% to a 5-year loan at 4%, that $70 a month payment increase will get the debt off your back 5 years sooner at a total savings of almost $2800. (Again, all these numbers are for a loan of $10k; you can multiply or divide every dollar amount here accordingly to match a larger or smaller debt.) Would you take a couple of nice dinners less per month in the short term to pay your debt off twice as quickly?

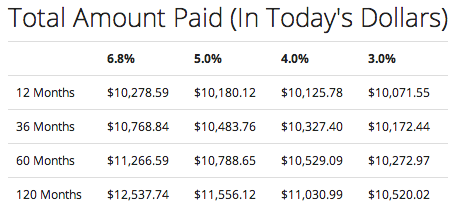

One additional aspect to factor in to these calculations is inflation. For the past few years, annual inflation in the US has been hovering at around 2%, so if that trend continues, by the end of your loan the amount you’re paying won’t be worth as much anymore in terms of what you could otherwise buy with the money you’re paying. Fortunately, the calculator also does this calculation for you, to give an approximate total cost of your loan over time in terms of today’s value of money:

So even measured in today’s dollars, getting your rate down to 4% on a 5-year term from 6.8% on a 10-year term will save you over $2,000 for every $10,000 you owe. That’s a nice chunk of cash!

As WeFinance helps more of our borrowers refinance debt at 4% or lower, the total amount we’re helping them save will start really adding up. We’ll hopefully have some stats to share on that front in the coming weeks.

This is a really important and insightful way to look at loans and interest. Thank you!

LikeLike