At WeFinance, we spend a lot of time thinking and talking about the huge disparity between the interest rates that those with student debt are often forced to pay on their traditional student loans and the interest rates people can routinely earn on their savings. We think that many borrowers stand to benefit from an option that reduces their rate. But, at the same time, we realize it’s not always simply a matter of interest rate. There are several other factors to consider when comparing loan options, and one factor that many borrowers cite as key to their decision making is the length of time they have to repay the loan.

Depending on the repayment plan they’re under, a borrower might have between 10 and 25 years to repay their loan. That loan will cost a fortune in interest over that length of time, but a borrower may not feel they can commit to paying everything back in a shorter time period, especially if they already feel like their monthly payments are close to the limit of what they can currently afford. So they worry that options like WeFinance-where their refinancing comes from real people in their network, who may not be able to wait as long as 10 or more years to be repaid-may not make sense for them.

The incredible thing about compound interest, though, is that even refinancing a small part of your loan at a lower rate can save you a ton of money. And, one good thing about most traditional student loans is that there’s no penalty for repaying a larger share of the loan early. So, even if you can only afford a few extra dollars a month now, you can save thousands in the long run with a partial refinance. And, even if your current situation doesn’t allow any increase in monthly payments, you might be able to save money anyway and even lower your current monthly payments with a partial refinance loan with payments deferred. (WeFinance loans, for example, can either have monthly payments or a lump-sum payment at the end, at the discretion of the borrower.)

To help illustrate this, we released a new ‘Five-Year Plan’ calculator this week. In about 30 seconds, you can see how various partial refinance options with lower rates over five years can save you a bunch of money relative to just simply paying off your current loan over 10 years.

For example, if you owe $50,000 at 6.8%, even just refinancing $5,000 of that loan, at a cost of less than $35 a month for the next 5 years, would save you nearly $60 a month for the 5 years after that, and $1,380 overall.

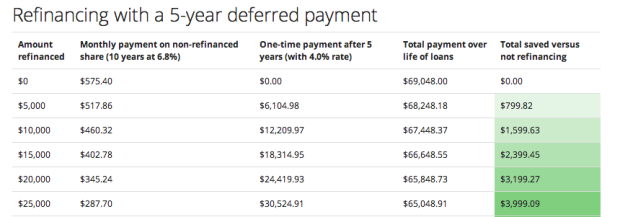

And, with a 5-year loan with deferred payments, you could actually lower your monthly payment by nearly $60, and still save about $800 overall, by refinancing just $5,000. (And, of course, the amount saved goes up the more you refinance.)

Of course, everyone’s exact financial situation is different, and thinking carefully about what payments you’ll be able to afford when is extremely important. But even if you don’t know exactly what your financial future holds, there still might be a lot of money you can save. Try our calculator, check against your own loan information (remember, things may be slightly different depending on the rules of your specific loans), and see what makes sense for you.